is maine tax friendly to retirees

Wolters Kluwer Outlines State Tax Considerations for Retirees Tax Foundation. Use this guide to get help determining which states are tax-friendly for retirees.

Beware These 15 Worst States For Taxes On Your Retirement

State of Connecticut Department of Revenue Services.

/cloudfront-us-east-1.images.arcpublishing.com/gray/RKLX2FW7AVCPHJWJNBNME372RE.png)

. AL has state taxes ranging from 4 - 75 and property taxes that are some of the lowest in the country at 04 - they also offer a homestead exemption for seniors age 65 and older which may cover up to 100 of state property taxes. Tax codes vary from. The Pine Tree state has an 85 percent top marginal income tax rate and hefty property taxes to boot.

Maine also hits wealthy retirees hard. Employer funded pension plans exempt these self-funded plans may be fully or partly taxable. Other retirement income is taxed as regular income ranging from 2 to 5.

Our mission is to protect the rights of individuals and businesses to get the best possible tax resolution with the IRS. Know more about tax friendly states for retirees. According to Sperlings Best Places an online data resource the cost of housing.

States like Alaska Floriga Georgia and Nevada are some of the tax-friendliest for retirees. Finding the best state to retire can be difficult without doing some research. Ad Retirement plans for state employees.

FICS-selected content is not intended to provide tax legal insurance or investment advice and should not be construed as an offer to. Social Security income tax breaks if AGI is 4300058000 or less. For nature lovers and those looking to retire in a place that offers the feeling of being far away from the rat race this may be the place.

Retirement income exclusion from 35000 to 65000. How all 50 states rank for retirement friendliness. Kiplinger calls it the least-tax-friendly state for retirees.

Depending on where you live when you retire you may have to pay all of these taxes or just a few. Maine Relative tax burden. Social Security income is not taxed.

These simple tricks can help lower retiree tax bills. Use this interactive map to view how all 50 states plus the District of Columbia are ranked for their retirement-friendliness. MissionSquare - recognized for our commitment to diversity equity and inclusion.

Is maine a tax friendly state for retirees. Hawaii at 438 percent Wyoming at 538 percent and Maine at 500 percent. Low property tax is especially important for many retirees who may live in larger homes but have limited income streams.

Tax friendly states charge fewer taxes that might apply to retirees like income tax capital gains tax property tax and sales tax. 800-352-3671 or 850-488-6800 or. There may be a silver lining though.

States to Steer Clear Of. 404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes. Value-driven plans for the public sector.

Beware These 15 Worst States For Taxes On Your Retirement

Beware These 15 Worst States For Taxes On Your Retirement

Beware These 15 Worst States For Taxes On Your Retirement

Best Retirement States New Hampshire Colorado Maine Top New List

Beware These 15 Worst States For Taxes On Your Retirement

Best And Worst States For Middle Class Taxpayers Cheapism Com

Best Retirement States New Hampshire Colorado Maine Top New List

Top 20 Military Friendly Places To Retire

State By State Guide To Taxes On Retirees States And Capitals Funny Retirement Gifts Retirement

Is Maine Vermont Or New Hampshire Cheaper Overall To Live Quora

Portland Maine Travel Guide Jess Ann Kirby

The Best Places To Retire For Tax Advantages

Best Retirement States New Hampshire Colorado Maine Top New List

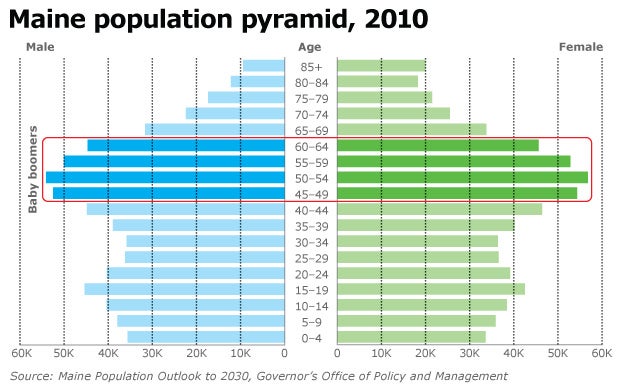

Wealth Managers Seek Baby Boomer Clients Mainebiz Biz

Beware These 15 Worst States For Taxes On Your Retirement

Best States To Retired In With The Lowest Cost Of Living Finance 101